Save With Federal Tax Credits

Inflation Reduction Act Tax Credit

Save Money on Clean Energy Upgrades

Up to $1,200 Credit

For home improvements,

including efficient windows, exterior doors, insulation, electrical panel upgrades.

Up to $2,000 Credit

For air source heat pumps

heat pump water heaters and biomass stoves/boilers

Eligible Home Improvements

New York homeowners can use IRA tax credits to reduce the cost of home energy efficiency improvements, energy-saving renovations, and installing efficient heating and cooling systems.

The IRA enhanced the existing Energy Efficient Home Improvement allowing homeowners to claim 30% of the costs on eligible improvements instead of 10%. From 2023 through 2032, New Yorkers can claim up to $3,200 in efficiency tax credits a year for eligible purchases, including:

- New York homeowners can use IRA tax credits to reduce the cost of home energy efficiency improvements, energy-saving renovations, and installing efficient heating and cooling systems.

- Up to $2,000 for air source heat pumps, heat pump water heaters and biomass stoves/boilers.

These home improvements represent cost-effective ways to reduce energy use, improve comfort, and save money. Many of these upgrades are also eligible for New York State incentives, helping homeowners get back some hard-earned cash for other home purchases.

For example, cold-climate air source heat pumps, which provide both home heating and cooling, are eligible for rebates through NYS Clean Heat Link Savings on these efficient, emission-free systems average $2,000-$3,000 for whole-home solutions and $100-$400 for partial solutions.

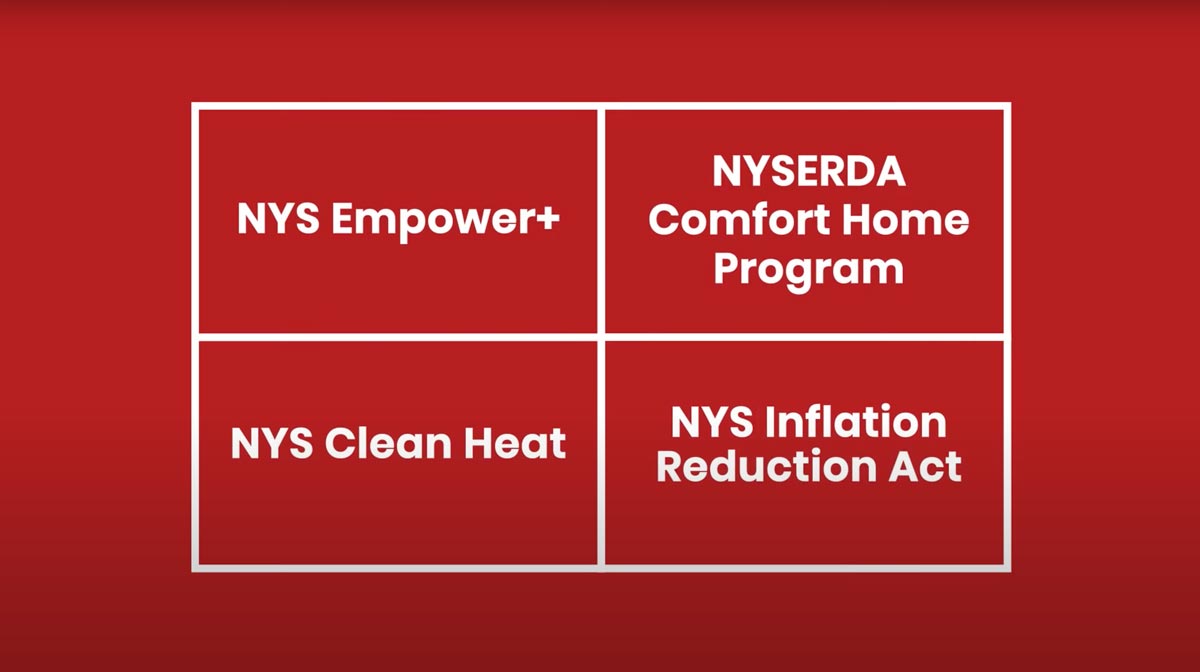

Don't Miss Out On NYS Rebates

These home improvements represent cost-effective ways to reduce energy use, improve comfort, and save money. Many of these upgrades are also eligible for New York State incentives, helping homeowners get back some hard-earned cash for other home purchases.

Cold-climate air source heat pumps, offering both home heating and cooling functionalities, qualify for rebates through NYS Clean Heat. These efficient, emission-free systems typically yield savings averaging between $2,000 and $3,000 for whole-home solutions, and between $100 and $400 for partial solutions.

Furthermore, NYS Clean Heat extends rebates for ground source heat pumps, which are eligible for a 30% IRA tax credit and a 25% New York State income tax credit. Heat pump systems are increasingly prevalent across New York and the U.S., with national heat pump sales surpassing those of gas furnaces in 2022.